In the dynamic world of real estate finance, the integration of blockchain technology has paved the way for a groundbreaking innovation known as the mortgage blockchain ecosystem. This interconnected network of platforms, protocols, and participants is revolutionizing the way mortgages are originated, serviced, and securitized, offering unprecedented levels of efficiency, transparency, and security to stakeholders across the industry.

At the heart of the mortgage blockchain ecosystem lies the utilization of blockchain technology, a decentralized and immutable ledger system that records and verifies transactions across a network of computers. This technology serves as the foundation for various applications and solutions within the ecosystem, each designed to address specific pain points and challenges in the mortgage process.

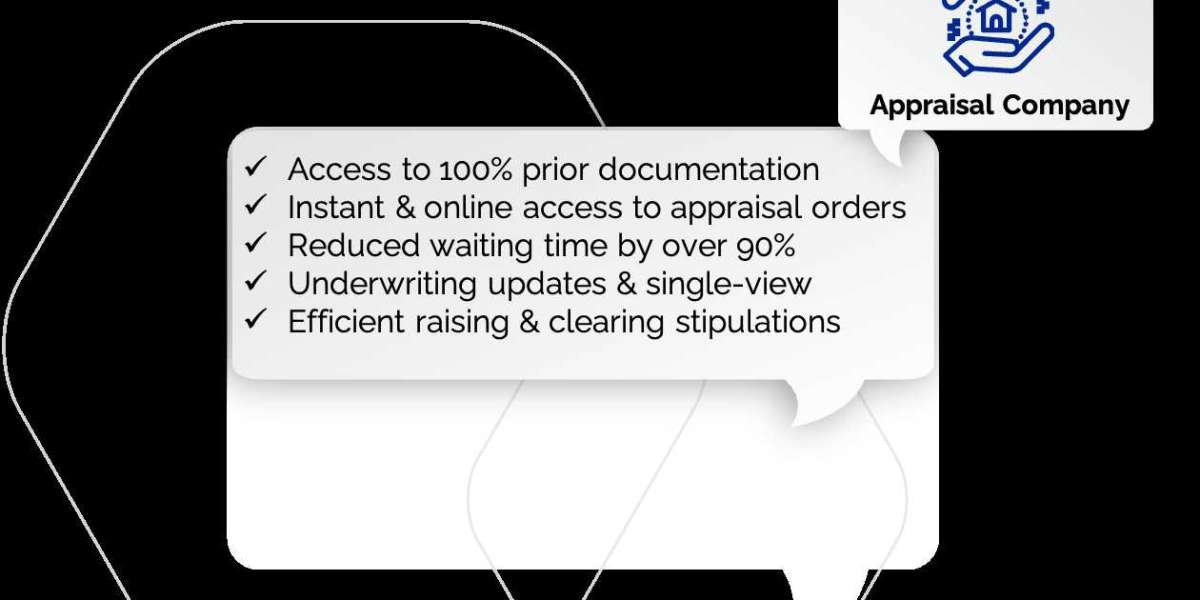

One of the key components of the mortgage blockchain ecosystem is the digital mortgage platform, which serves as the interface for borrowers, lenders, brokers, and other parties involved in the mortgage transaction. These platforms leverage blockchain technology to streamline the mortgage application and approval process, automate underwriting and verification procedures, and facilitate seamless communication and collaboration among stakeholders. By digitizing and automating traditionally manual processes, digital mortgage platforms reduce paperwork, minimize errors, and accelerate the speed at which mortgages are originated and funded.

Another essential element of the mortgage blockchain ecosystem is the use of smart contracts, self-executing contracts with the terms of the agreement directly written into code. Smart contracts play a crucial role in automating various stages of the mortgage lifecycle, including loan origination, payment processing, and escrow services. For example, smart contracts can automatically verify borrower information, trigger the disbursement of funds upon satisfaction of predefined conditions, and record the transfer of property ownership on the blockchain. This not only eliminates the need for intermediaries but also ensures the timely and accurate execution of mortgage agreements.

Furthermore, the mortgage blockchain ecosystem encompasses tokenization platforms that enable the fractional ownership and securitization of mortgages. These platforms tokenize individual mortgage loans, converting them into digital assets that can be traded on blockchain-based marketplaces. By breaking down mortgages into tradable tokens, tokenization platforms democratize access to real estate investments, allowing investors to diversify their portfolios and participate in high-value assets that were previously inaccessible. Additionally, tokenization enhances liquidity in the mortgage market, making it easier for lenders to originate loans and investors to buy and sell mortgage-backed securities.

In addition to digital mortgage platforms and tokenization platforms, the mortgage blockchain ecosystem includes regulatory compliance solutions, data analytics tools, and identity verification services, all of which contribute to the efficiency, transparency, and security of mortgage transactions. These ancillary services help ensure compliance with regulatory requirements, detect and prevent fraud, and provide insights into market trends and borrower behaviour.

Despite the immense potential of the mortgage blockchain ecosystem, challenges such as regulatory uncertainty, interoperability issues, and data privacy concerns remain. However, as governments, financial institutions, and technology providers collaborate to address these challenges, the adoption and expansion of the mortgage blockchain ecosystem are expected to accelerate in the years to come.

In conclusion, the mortgage blockchain ecosystem represents a transformative force in the real estate finance industry, offering a secure, transparent, and efficient alternative to traditional mortgage processes. By harnessing the power of blockchain technology, this ecosystem has the potential to unlock new opportunities for borrowers, lenders, investors, and regulators alike, ultimately driving greater efficiency, inclusivity, and trust in the mortgage market.